New York Inflation Refund Checks: What You Need to Know

In the last two weeks, you may have received a check from New York State as part of Governor Kathy Hochul’s “inflation refund” program. These one-time payments are intended to help eligible New York residents with a little extra financial support this fall. The checks are being sent to residents who filed taxes in 2023.

Surprised to get the check or wondering why you haven’t gotten one? We’re here to break down what this payment means, who qualifies, and how it might affect your 2025 taxes.

What do I need to do to receive the check? Do I need to apply?

No application is necessary. If you filed New York State taxes in 2023(Form IT-201) and your income for 2023 meets the income eligibility requirements (see below), you will automatically receive a check in the mail.

Where will the check be mailed to?

The check will be mailed to the address listed on your most recently filed tax return. If you filed your 2024 tax return with your current address, that’s where your inflation refund check will be mailed.

I have moved since I filed my last tax return with New York State. How can I update my address with the Department of Taxation and Finance?

If you have moved since you filed your 2024 return – or you have not yet filed for 2024, then you can update your address with the Department of Taxation and Finance using your Individual Online Services Account. If you do not have an Online Services Account, see how to create one here: Create an Online Services Account.

If you update your address this week, there should still be enough time for your check to be sent to the new address.

When will the checks be delivered?

The checks started going out at the end of September 2025 and will continue to be sent through the end of November.

How can I check the status of my check delivery?

There is currently no way to track the status of your check or its delivery.

Do I have to pay taxes on the inflation refund check?

Yes, you may have to pay federal taxes. If you itemized deductions on your 2023 federal tax return, then you will need to include the inflation reduction check as federal income on your 2025 IRS Form 1040. However, if you claimed the standard deduction in 2023, the check is not considered taxable, and you do not need to report it on your 2025 federal tax return.

You do not need to report the inflation refund check on your 2025 state taxes.

If you need help or have questions, we’re here to help! Join one of our upcoming Drop-In Tax Tables for free, expert guidance (click here to make an appointment).

How do I make sure this check is properly included in my taxes?

If the check needs to be included on your federal taxes, be sure to keep a copy of the check. Work with a tax advisor to ensure that the check is reported correctly and avoid any penalties.

Are any scammers trying to take advantage of this program?

The Department of Taxation and Finance website is alerting New Yorkers that scammers are calling, mailing, and texting people claiming to need personal information about the individual before they can receive a check—that is not true. You do not need to provide personal information for this program and if anyone contacts you claiming to be from the “Tax Department,” you can report it here.

I did not file a New York resident income tax return for 2023. Will I still receive a check?

No, only individuals who filed a 2023 New York State resident income tax return (Form IT-201) are eligible to receive the inflation refund check.

I was a part-year resident with New York source income in 2023. Will I receive a check?

No. To qualify you must have been a full-year New York resident with New York source income in 2023.

If I owe money to New York State or the IRS, will my check be applied to those debts?

No. The inflation refund check will not be applied to any outstanding state or federal debts.

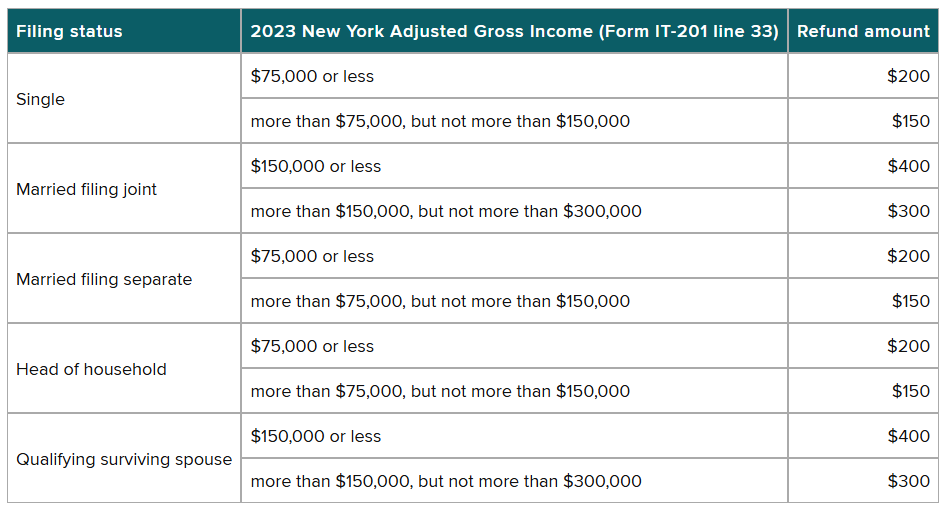

What are the income requirements, and how much will I receive?

Based on your 2023 filing status, the income requirements and refund amount are as follows (click here to view on the NY Department of Taxation and Finance website):